Solar Energy in Plainfield, IL

Request Free Consultation

Upgrade to Solar Energy Thanks to Mint Green Solar

Are you looking for solar energy in Plainfield, IL? Mint Green Solar has been a trusted provider of solar electricity services in the Chicagoland area and Chicago's western suburbs since 2018. We are committed to delivering reliable, efficient, and sustainable energy solutions tailored to your property's unique needs. Our comprehensive approach ensures not only the installation of high-quality solar panels but also a thorough evaluation of your home’s overall energy efficiency. With our extensive experience and dedication to customer satisfaction, you can trust us to guide you through every step of the process, from the initial consultation to the final installation and beyond.

Our team at Mint Green Solar prides itself on its expertise and dedication. We offer FREE next-day estimates and consultations to help you understand your solar options without any obligation. Our holistic approach to energy efficiency means we consider all aspects of your home’s energy use, ensuring that you get the most out of your investment. We are committed to transparency and communication, keeping you informed every step of the way. With our licensed and insured professionals and access to top industry brands, you can be confident in the quality and reliability of our services. Give us a call today to schedule your FREE consultation.

Why Choose Mint Green Solar?

Choosing Mint Green Solar means opting for a company with over 20 years of solar industry experience and a proven track record of excellence. Our commitment to speed and communication ensures a smooth and stress-free process, with most services completed within 60-90 days. We offer USA-manufactured products backed by a minimum 25-year, and up to 30-year, full system warranty, providing you with peace of mind and long-term savings. Our patient and knowledgeable team is always ready to answer your questions. We make it easy for you to start your transition to sustainable energy so call today to get started with Mint Green Solar! Ask about our great financing options.

Free Next-Day Estimates

Licensed and Insured

Full System Warranties Available

Free Solar Consultations

Products Made in the USA

Over 20 Years of Experience

Solar Power Solutions

At Mint Green Solar, we provide comprehensive solar power solutions that cater to the specific needs of your home or business. Our services include the installation of high-efficiency solar panels and equipment, ensuring you maximize your energy savings. We use only the best products from leading industry brands, all manufactured in the USA. Our expert team will work with you to design a customized solar system that meets your energy goals and budget, ensuring a seamless transition to renewable energy.

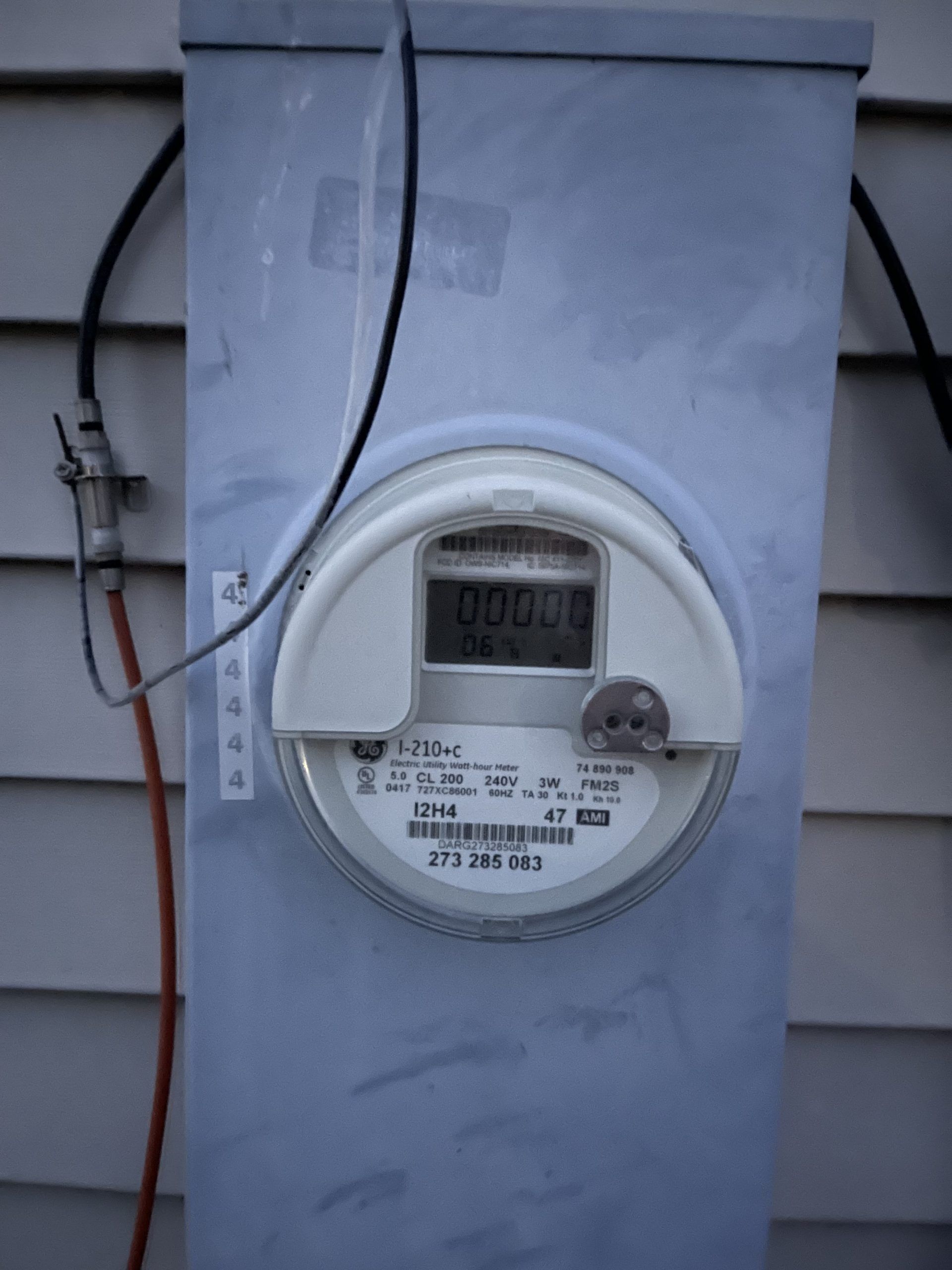

Do You Qualify?

Did you know that the state of Illinois will pay for you to go solar if you sell them back your SREC credits? Our team at Mint Green Solar can help you determine if you qualify for this program, saving you even more money on your new solar energy system. Our goal is to make the process as simple and informative as possible, helping you make an informed decision about your energy future. If you're in the Chicagoland area and interested in upgrading to solar energy, call us at (331) 207-3197 today.

Testimonials

Our satisfied customers are our best advocates. At Mint Green Solar, we take pride in the positive feedback we receive from our clients. From seamless installations to significant energy savings, our testimonials showcase the quality of our work and the dedication of our team. We invite you to read their stories and see for yourself why so many in the Chicagoland area and Chicago's western suburbs trust us for their solar electricity needs. We hope that you'll become our next happy customer with Mint Green Solar!

Check Out Our Past Solar Installation Projects

Since 2018, Mint Green Solar has been installing the latest in state-of-the-art solar energy equipment for local homeowners in and around the Chicagoland area. See below for some examples of our top-notch work in the past, then give us a call to schedule your FREE consultation. We make the entire process as easy and efficient as possible.

Here's what our satisfied customers are saying...

At Mint Green Solar, we take pride in providing exceptional solar power solutions to our customers. We would be grateful if you could share your thoughts about our solar energy systems with others. Your feedback helps us improve and helps others make informed decisions. Please take a moment to leave a review of Mint Green Solar and let others know what you think.

Share On: